Industry benchmarks suggest that most organisations waste 3 to 4 percent of their overall external spending on high transaction costs, inefficiency, and noncompliance and which in turn have a greater impact on return on investment (ROI).

Procure-to-pay automation is a system designed to add efficiency to the processes of vendor evaluation, and selection with the help of technology. P2P automation seeks to use software to eliminate manual tasks, streamline collaboration between departments, and save money through increased accuracy and reduced labour. It’s a process that naturally brings together two separate points of potential cost reduction for any modern company: Procurement and Accounts Payable.

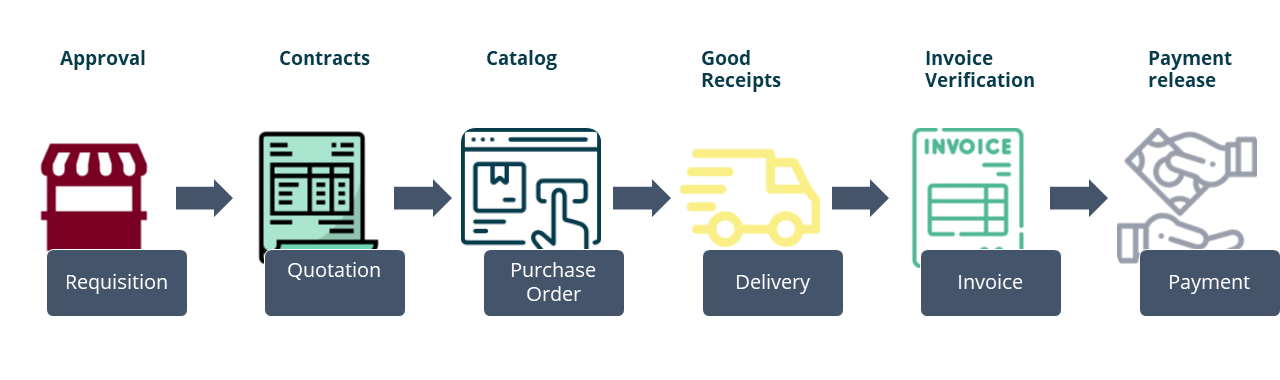

The P2P process can be broken into a simple series of steps:

Requisition of Goods and Services – Creating and submitting for approval an official internal request for goods and services.

Purchase Order – Generating the documents necessary to officially request from the vendor a specific amount of goods or services, as well as terms and conditions to be met by the vendor fulfilling the request. Some companies may use two-or three-way matching (connecting POs to Receiving Documents to Invoices) to simplify the verification process.

Receiving Goods – Taking delivery of physical goods and documenting the details, as well as adding the items to the inventory management and accounting systems.

Reconciliation – Reviewing the invoice received from the fulfilling vendor and comparing it to the original purchase order to verify all information is correct, including costs and fees.

Payment via Accounts Payable – Processing the purchase order, submitting payment to the vendor, and adding the amount paid into the company’s accounting system.

Tackling these processes manually—the standard in the days before widespread computerization—was tedious, time- and labour-intensive, and rife with potential for both costly human errors and even costlier fraud.

Requisition automation ensures that an organization is always in complete control of company spending from the start. Finance leaders create predefined catalogs using workflow tools with approved suppliers. Requisitioners can then choose products and services directly from this collection. This means that full visibility is maintained over what is being purchased and why.

All types of invoices (including paper, PDF, fax, EDI, XML, and email) can be automatically captured through automation. Touchless processing for most invoices through capture, matching, and approval means that only exceptions need to be handled by team members. Problems such as duplicate invoices, missing PO numbers, and unregistered suppliers are stopped at the source before they cause more significant problems and more work downstream.

RPA Bots seamlessly interact with a range of applications and systems, including ERP or any accounting system to feed the extracted data. By automating the invoice data entry process, The approval process can be expedited and the risk of human errors and the cost associated with it can be minimized.

The matching of invoices against purchase orders (POs) is called a two-way match, and when matched against both POs and goods receipts, it is called a three-way match. This process involves comparing invoices line-item-by-line-item against these essential documents to reconcile discrepancies in purchase amount or vendor contact information. RPA Bots can automate most of this manual matching, thus reducing oversight required and exception handling. As a result, employees can focus on more critical financial responsibilities, such as budgeting and planning.

Approval automation allows for invoices to be routed electronically, reducing approval times. In addition, complex rules based on roles, hierarchies, and varying approval limits can be configured to ensure adherence to company spending policies. Sophisticated workflow automation can even enable approval routing across multi-entity organisations.

P2P automation software integrates seamlessly with an organization’s existing ERP system. This ensures complete visibility of the entire P2P process, along with a complete audit trail for every transaction. Reporting analytics enable finance leaders to continuously monitor and improve operational P2P processes while also delivering timely and accurate month-end reporting.

1. Automatic Notifications:

2. Data log and audit history

3. Analytics and forecasting

By minimizing human intervention in invoice processing, and automating approvals and exceptions, companies can reduce turnaround times drastically. Highly repetitive and laborious accounts processes such as invoice processing make the ideal use cases for process automation. Not only do organisations benefit from going paperless, but they make significant gains in terms of invoice processing speed, accuracy, and costs.

AMO has designed a bespoke P2P application for a multinational biopharmaceutical company with an intuitive role-based interface. This P2P platform is now being used in 32 countries with around 150K transactions yearly. With this application, our customer has been able to decentralise its purchasing, distribute approval rights as well as benefit from a self-audit portal for compliance management.

Want to know more about how to create value in your shared services and how to redefine your procure-to-pay process, get in touch with us!

We gather information about your needs and objectives of your apps. Unsure about the app you need? We will carefully assess your top challenges and provide expert guidance on the perfect solution tailored to your success.

We create wireframes and an interactive prototype to visualise the app flow and make changes as per your feedback.

Estimation of the project deliverables including the resources, time, and costs involved.

Showcasing POC to relevant stakeholders illustrating the functionalities and potential of the app to meet business objectives.