The trend over the past decade has been to adopt and integrate more innovative ways of working across critical business services. Many of these improvements have focused on finance processes, given their significance in supporting enterprise operations. Nevertheless, lucrative opportunities remain.

Every workflow and process in your finance department involves a range of people, systems, and data. Automation helps in coordinating all the moving parts by eliminating manual tasks, enhancing collaboration, and keeping work items in motion. This is not to say that it replaces people with robots. It simply means we use automation to handle repetitive, time-consuming manual tasks. By automating these aspects, people in your department can direct their efforts toward creating value and driving strategy.

Finally, the trend over the past decade has been for finance functions to partner with the business in a more collaborative way, to support the latter’s objectives. Meeting service-level agreements alone is not enough. Today, given the ability to automate transactional work, functional teams can focus on the underlying data and intelligence that is so critical to the enterprise. Moving into a true business partnership role defines enterprise success!

The roles and responsibilities of the finance teams are constantly changing. With the range of technologies now available there is no excuse to soak up your finance team’s valuable time and effort with clunky manual processes. The primary goal of finance automation is to improve process efficiency by reducing or eliminating repetitive tasks or activities that do not add value and achieving business process excellence. Let’s dig deeper into the importance of automating finance processes

We know there is a colossal list of processes in finance, but we cannot automate everything as it has some limitations, so let us discuss the core process which can be automated to so keep your business floating. Let us start with addressing the elephants from the list.

An accounts payable typically includes several manual processes, such as:

With finance automation your accounts payable system directly to purchasing or reimbursement workflows to be sure you process only approved invoices. You can also use automation to integrate accounts payable processes with financial planning tools so that budget is allocated automatically before invoices reach accounts payable.

Requests that seem straightforward can become bottlenecks when there are many employees submitting requests in multiple channels. Common challenges include:

Automation can address these pains by:

The ad hoc nature of many purchasing requests results in purchase requisitions with missing or incomplete information. Common problems include:

You can avoid these issues by using finance automation to standardize purchase request creation, and set purchasing conditions, mandatory actions, and automation rules that prevent errors and ensure policy compliance when purchasing requests are processed.

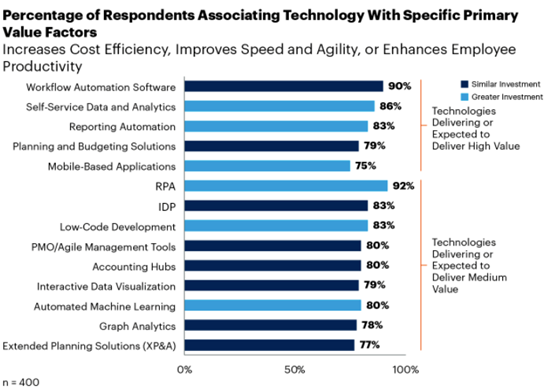

*Source: Gartner (April 2022) Report

The team at AMO combines unmatched technical and business expertise to create innovative, tailor-made software solutions that deliver world-class financial operations and insights. From assisting our customers to automate their end-to-end finance and procurement processes, to delivering applications for financial review committees, we have enabled them to bring control, visibility, accountability, and efficiency to their finance workflows.

Want to know more about finance automation, join AMO Consultancy and Nintex in London on the 15th of November. This in-person event will focus on creating value in Shared Services Organisation and how to rethink your finance and procurement functions amidst uncertainty.

We gather information about your needs and objectives of your apps. Unsure about the app you need? We will carefully assess your top challenges and provide expert guidance on the perfect solution tailored to your success.

We create wireframes and an interactive prototype to visualise the app flow and make changes as per your feedback.

Estimation of the project deliverables including the resources, time, and costs involved.

Showcasing POC to relevant stakeholders illustrating the functionalities and potential of the app to meet business objectives.