Insurance processes used to be seen as long, drawn-out, and paper-heavy. From the information section and endorsement to claims handling there is continuously an approaching chance of process mistakes due to human errors when there is a heavy reliance on manual paperwork. With process automation taking unprecedented importance in other industries, customers now expect the same speedy excellent customer experience from insurance companies, whether they are applying for a new policy or making a claim.

However, the insurance market is full of stringent regulations; hence, digitising the end-to-end processes in the insurance industry is not as straightforward. Not to mention the myriad of legacy systems that insurers have accumulated over the years as they tried to modernise and maintain their competitive advantage.

In my previous blog, I deep-dived into the automation of insurance processes and the different use cases of automation in this industry. I have discussed how Digital Process Automation (DPA) orchestrates people, applications, and information across an insurance business. By integrating systems and eliminating silos, employees are provided with the single view of data they need to make decisions and perform services efficiently throughout the customer’s journey, from onboarding to underwriting and claims.

Here we are going to discuss the data-driven part of the insurance business and how automation in data mining can help the industry grow exponentially.

Data is the driving force to understand customer behaviours, assess risks, and enable businesses to make data-driven decisions in line with their objectives.

Having the relevant data about customers in the insurance industry can ensure that the right policy is being provided based on their needs. The data used in insurance creates a picture of the customers and the likelihood that something might happen and protects them if it does. With all the new technologies available today, this data can be used in different ways that can benefit customers. For example, the insurance company may ask to install sensors in a customer’s house which can detect gas or water leaks to minimise any damage caused to the customer’s home, or the company can mark the area and install sensors to monitor earthquakes or storms which helps them to determine the danger zone and decide the premium accordingly.

To calculate how much premiums should be and the probability of an event happening, insurers need data. This data can be specific to customers or could be more general, but it all helps to build a good view to insurance companies to provide the cover customers need if the unexpected happens.

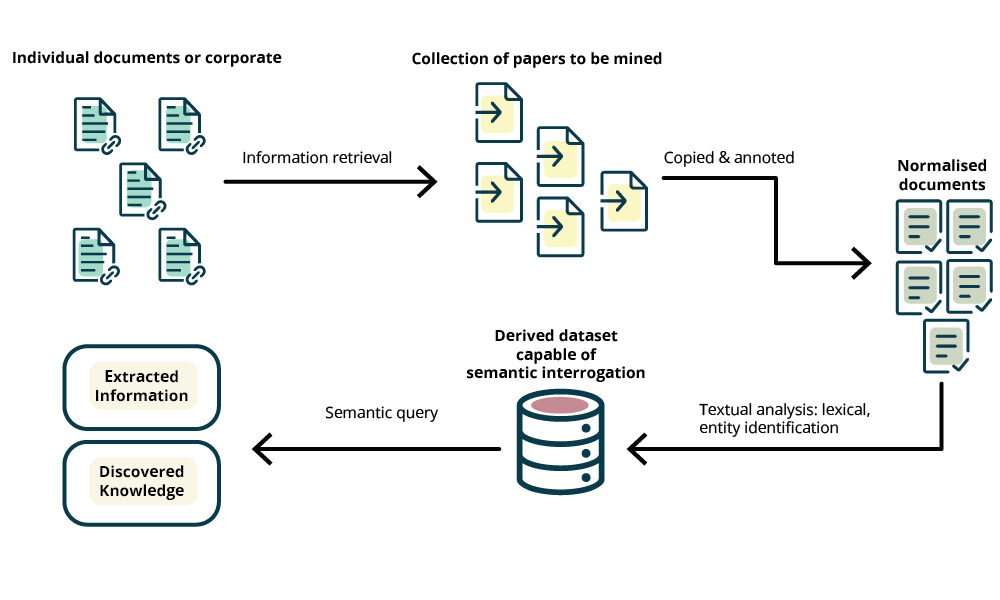

Historically, the insurance industry has collected vast amounts of data relevant to their customers, claims, and so on. This can be unstructured data in the form of PDFs, text documents, images, and videos, or structured data that has been organized for data analytics. As with other industries, the existence of such a trove of data in the insurance industry led many of the larger firms to adopt data analytics and techniques to find patterns in the data that might reveal insights that drive business value. Most of the data that insurance firms collect is likely unstructured to varying degrees. The key to solving the challenges that insurance companies face in collecting and structuring their data is the successful implementation of Artificial Intelligence (AI) systems.

For example, insurance companies might have thousands of signed claims forms or contracts coming in every day. These documents need to be checked to see if there are any changes to the original. Traditionally, this task was done by humans, but machine learning can certainly handle this and eradicate the risks of human errors.

Let’s have a look at some of the use-cases where AI is being applied for data search and data discovery in the insurance sector below. Natural Language Processing (NLP) based document search and data mining software are seemingly most useful for the following three:

AI vendors today also offer end-to-end solutions for insurance firms that allow for document digitization and use NLP to find and retrieve information from documents in a contextual manner.

Flexible and on-demand insurance products are increasingly becoming more widespread; for example, some providers offer monthly rolling contracts for content insurance. Another flexible product is travel insurance which is tracked, with the customer’s consent, through the GPS in the policyholder’s smartphone, so their cover automatically switches on when they enter a different country. This ensures a slick and convenient service that automatically switches to an annual cover when it reaches a threshold amount. These types of flexible products have emerged to meet the changing needs of customers, particularly those who are technologically savvy. We expect on-demand insurance and usage-based insurance (UBI) to become increasingly popular and for new products to emerge.

The Internet of Things has helped create products that focus on prevention or situational insurance, for example, a sensor will be able to monitor a household’s water consumption patterns, detecting potential leaks and interrupting the flow before the basement is flooded. This can prevent major damage and a potentially costly claim.

The technology that most insurers have currently in place to help to fight fraud is a blend of business rules and database searches, where the results rely heavily on the sensitivity of the claims auditor. While these techniques have proved to be successful in detecting known fraud patterns, insurers today need to invest in new analytical capabilities to help them spot unknown and complex fraud activities. These analytical capabilities include:

Incongruity detection

Aims at discovering fraud by identifying those elements that vary from the norm. Key performance indicators associated with tasks or events are baselined and thresholds set. When a threshold for a particular measure is exceeded, then the event is reported. Outliers or anomalies could indicate a new or previously unknown fraud pattern.

Predictive modeling

Use past fraud events to produce fraud propensity scores. Adjusters simply enter data and claims are automatically scored against the likelihood of them being fraudulent. These scores are then made available for review. The use of predictive modeling makes it possible to understand new fraud trends.

Social network analysis

Analysis of network connections so they can uncover previously unknown relationships and conduct more effective and efficient investigations.

While these technologies are still in their early stages, the bottom line is that data analytics can be used to explore large volumes of networked data, using high-speed processing with configurable data entry from multiple internal and external sources, to reveal fraudulent behaviours.

Our experts at AMO design and build bespoke digital automation solutions based on our customers’ requirements. Our web-based automation solutions enable the bridging of silos and the creation of an end-to-end automated insurance process. This starts with data retrieval with intelligent OCR, processing that data through data models to get refined/structured data sets, and finally feeding the processed data through automated workflows process with business rules. We leverage technologies such as Nintex K2 and UiPath and create applications that integrate with your existing systems to surface the data.

Want to know more about how we can help you automate your business processes, get in touch with our team!

We gather information about your needs and objectives of your apps. Unsure about the app you need? We will carefully assess your top challenges and provide expert guidance on the perfect solution tailored to your success.

We create wireframes and an interactive prototype to visualise the app flow and make changes as per your feedback.

Estimation of the project deliverables including the resources, time, and costs involved.

Showcasing POC to relevant stakeholders illustrating the functionalities and potential of the app to meet business objectives.